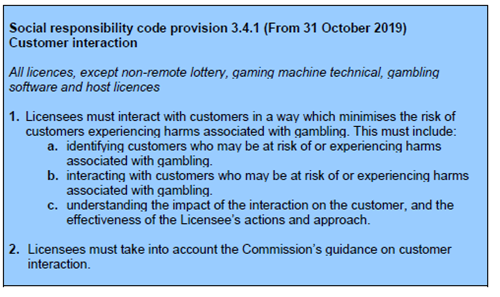

On Monday 27th July the UK Gambling Commission issued further formal guidance for Customer Interaction in Social Responsibility Code 3.4.1 of the Licence Conditions and Codes of Practice (LCCP).

The main commentary is in ensuring a greater level of interaction takes place with clients based on acting upon various triggers that may indicate unhealthy changes in a customer’s betting activity.

As expected, affordability plays yet another key role. The UKGC says:

2.8 Historically, gambling operators have not systematically considered customer affordability when developing their customer interaction policies. Many have used deposit or loss thresholds as a main or sole prompt for a customer interaction, but these have often been set at levels that were inappropriately high, in comparison to the average amount of money that the majority of people have available to spend on leisure activities. This has led to a number of examples of customers spending more than they could afford, and this not being identified sufficiently early, as seen in much of the Commission’s compliance and enforcement casework since 2017.

2.9 Operators should aim to identify those experiencing or at risk of harm and intervene to try to reduce harm at the earliest opportunity. Reliance on deposit or loss thresholds that are set too high will result in failing to detect some customers who may be experiencing significant harms associated with their gambling. It is therefore imperative that threshold levels are set appropriately.

2.10 Open source data exists which can help operators assess affordability for their GB customer base and improve their risk assessment for customer interactions. Thresholds should be realistic, based on average available income for your customers. This should include the Office of National Statistics publications on levels of household income.

2.11 In considering these thresholds, you should be aware of the difference between ‘disposable income’ and ‘discretionary income’ which refers to the amount left after living costs are taken into account, but it does still include many other unavoidable costs. Most people would consider it harmful if they were spending a significant amount of their discretionary income on gambling.

Affordability means different things to different people.

At LendingMetrics, we know that affordability plays an essential part in understanding the net amount a customer can afford to spend. We have integrated data feeds from an array of sources to enable over 200 businesses to run automated affordability decisions based on each company’s own preferred affordability decisioning criteria.

We have worked alongside our customers to help build their affordability rules to enable an automated led decision in seconds as opposed to a manual review of bank statements and other data which can take hours. Our Auto Decision Platform (ADP) has revolutionised the industry, allowing our clients to build, edit and deploy their own decision strategy in real time. What’s more, the automated process can also work alongside manual reviews where required. Linked customer betting data can be integrated with the affordability decisioning, along with responsible gambling related triggers such as bet frequency and unusual betting spend or volumes.

Whilst the regulatory requirements being placed on operators are becoming more stringent, if past experience of other sectors is anything to go by, this phase of new regulations will simply be the first of many. Over time, regulators will look at how effective their measures have been and how operators have either complied with or “worked around” the rules. This was the case in the PayDay lending market, where the regulations were revised and tightened many times over several years. In such a fluid environment it is important for operators to be able to evolve and adapt quickly and seamlessly to new regulatory requirements.

Providers are rushing to market with novel solutions to individual operator challenges, however the truth is, no one data source, affordability score or KYC check will be sufficient in isolation; they need to be orchestrated as part of a combined approach. We would even go so far as to say that some of the solutions have yet to be created, not least because the regulations are evolving and still to be fully defined. That is why having an openly connected multi-discipline decisioning platform capable of pulling data from multiple sources is the only true basis upon which to build a solid foundation for regulatory compliance over the coming years. Our ADP solution delivers exactly that.

We can assist with these operational and regulatory challenges so you can focus on managing the core components of your business.

With decades of credit lending experience and an in-depth understanding of the gambling industry, LendingMetrics are able to support you with regulatory requirements whilst still maintaining your business model. If you are a gambling operator and are trialling various affordability possibilities, are wanting to discuss how best to approach affordability or have yet to automate your affordability process, then get in touch with us today on +44 (0) 2394 211010 or email sales@lendingmetrics.com.

The recent guidance issues by the UKGC can be viewed here.